How Does Inflation Affect Commercial Real Estate?

Commercial real estate is widely considered to be a good long-term hedge against inflation, as owners may benefit from stable income and the ability to increase rent.

Inflation in the U.S. has risen to levels we’ve not seen since the 1980s. Various macro factors are to blame. Supply shortages, higher commodity prices, and tightened financing followed unprecedented geopolitical uncertainty and the protracted global pandemic, leading to short-term interest rate hikes and slower economic growth.

In such an inflationary market environment, investors looking to preserve their wealth and the long-term performance of their portfolio should consider diversifying[1] into real estate. Commercial real estate (CRE) is widely considered to be one of the best inflation-resilient options. CRE may provide a source of stable income, and it may also allow owners to recoup some of their higher costs through rent increases.

Historically, commercial real estate has demonstrated strong performance throughout different economic cycles. In the last 25 years (1978-2022), U.S. commercial real estate outperformed inflation over 87% of the time.[2] This time period includes high inflation in the late 1970s and early 1980s.

In this article, we will explain the relationship between inflation, interest rates, and commercial real estate and provide some examples of the best property investments during high inflation.

Inflation and Purchasing Power

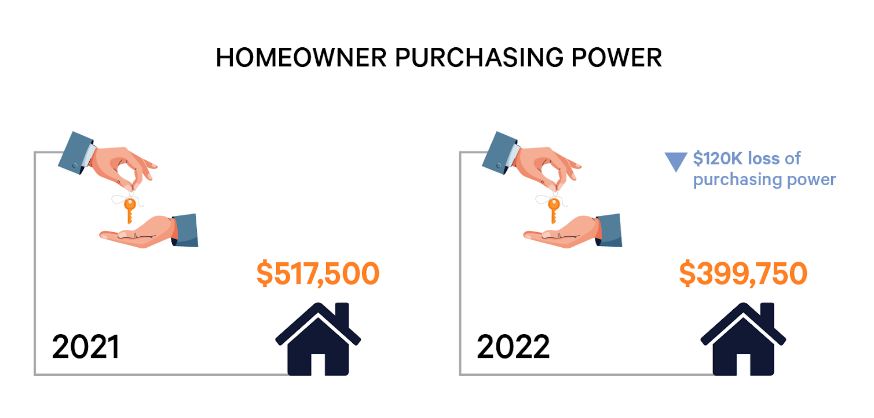

Inflation has a significant effect on an individual’s purchasing power. Purchasing power refers to the value of goods or services that can be bought with a single unit of any currency (such as $1). An increase in the price of goods and services typically decreases your purchasing power. When costs increase, you simply won’t be able to purchase as much as you could for the same price.

For example, a pound of coffee cost $6.4 on average in December 2022, while it was priced at $4.43 in 2020.[3] Supply shortages of coffee beans and trade disruptions have driven the price significantly. Effectively, $5 could get you a pound of coffee two years ago, but now you’ll need another dollar to buy the same product. In other words, your purchasing power is lower today, than it was in 2020.

This erosion of purchasing power in inflationary times certainly impacts the housing market. If the central bank raises interest rates to rein in high inflation (as the Federal Reserve has done) the cost of borrowing (debt, mortgages) goes up. When mortgage rates increase, it is harder for buyers to purchase property within their budgets.

In 2021, for instance, a homebuyer in the U.S. with a $2,500 monthly budget for their mortgage could afford to invest in a home worth up to $517,500, according to a recent study[4]. In 2022, however, the rise in interest rates means the homebuyer could only purchase a property that costs $399,750. The homebuyer lost $120,000 of purchasing power as a result of rising mortgage rates.

With fewer people willing and/or able to purchase property, the demand for rental housing has increased. Currently, mortgage payments in the U.S are said to be higher than the average rent in 45 of the 50 largest metro areas, making home ownership more expensive than leasing a property. A long-term investor in commercial real estate can capitalize on this uptick in demand and high occupancy levels by raising rents.

High inflation and interest rates also impact the supply side of the equation. The higher price of raw materials, labor and machinery coupled with greater borrowing costs make it costlier for developers to construct new properties. This is likely to reduce the overall housing inventory. Existing properties therefore appreciate in value, particularly in high-demand sectors like multifamily.

Real Estate as an Inflation Hedge

Commercial real estate has historically increased or maintained its value and overall performance during inflationary periods, and is considered a stable long-term investment. Investors can increase rental rates for fully-built properties to compensate for higher operating expenses or greater demand, so CRE is typically considered an attractive hedge against inflation.

The ability of a particular asset to hedge inflation can vary depending on the type of debt, lease duration, drivers of supply/demand, and cap rate movement. Investors may want to consider these factors before choosing their CRE investment.

- Type of underlying debt: Investors typically use a combination of equity and debt (such as loans provided in the form of a mortgage) to finance a real estate investment. Different types of mortgages have different levels of sensitivity to interest rates. A mortgage financed with fixed-rate interest throughout the period of the loan will be more stable in the face of fluctuating interest rates than properties with floating-rate (also called variable interest rate) debt. These types of mortgages adjust according to market conditions or a specific reference rate).

- Lease duration: Shorter leases allow investors to promptly revise rents or alter lease agreements to account for rising inflation. The length of a lease is specific to the property type. Hotels, for example, can reprice room rates daily. Co-working office spaces and alternative sectors such as self-storage often have month-to-month leases. The multifamily sector typically offers short-term leases, with the most common lasting 12 months. On the other hand, conventional office, industrial and retail leases are comparatively longer (10-20 years, in some cases) and it can be hard for landlords to quickly renegotiate lease terms during periods of unexpected inflation. Such longer leases typically contain what are known as escalation clauses. These increase rent annually by a modest percentage, which may or may not be enough to keep pace with higher rates of inflation.

- Structural supply/demand drivers: Property types that benefit from long-term trends will likely continue to see robust demand and positive rent growth irrespective of the macro environment. Take the multifamily sector, which benefited from the cultural shifts in how we live and work that accelerated in the early years of the pandemic. The industrial sector, too, saw accelerated demand due to rapid digitization and widespread adoption of e-commerce. Regional malls and suburban office buildings, however, face continuing headwinds. The trend toward hybrid working and reduced consumer spending has reduced occupier demand, produced higher vacancies, and lowered revenues. This is exacerbated during inflationary periods.

- Cap rate movement: Capitalization (cap) rate is the ratio between a property’s net operating income (NOI, the asset’s expected annual income minus management expenses) and its current market value. Cap rate is used to estimate a property’s potential cash yield before factoring in mortgage financing.

In general, when cap rates expand, the property’s expected risk and return levels also increase. This happens because the value of the property is derived either from higher projected future cash flows or lower current valuation. When cap rates compress, it means the property’s current equity valuation has increased. Generally speaking, property owners benefit from lower cap rates as it may mean that the value of their property has gone up.

Cap rates are influenced by a range of factors including interest rates, inflation, rent growth, Gross Domestic Product (GDP), and employment, as well as the property’s location and sector. These factors can all counterbalance inflation’s impact on cap rates. Higher interest rates would theoretically cause a cap rate expansion, but could be offset by a greater NOI, or a sector subject to growth tailwinds.

Housing shortages and rising rents have helped multifamily cap rates compress from 5.2% during the peak of the pandemic in Q2 2020 to around 4.5% in Q1 2022, despite mortgage rate increases[5]. Similarly, high demand for industrial space and low vacancy rates have lowered cap rates in the sector to 3.5% versus 6% in Q2 2020. Since cap rate is often a side effect of rising property prices, multifamily and industrial sectors have recorded the strongest price gains amongst their peers, at 22% and 30% respectively, as of the first quarter of 2022.

Your risk appetite as an investor should determine your cap rate expectations and investment selection, particularly during periods of high inflation. While almost all privately held commercial real estate may provide better inflation protection than stocks and bonds, some properties fare better than others. Historically, privately-owned multifamily apartment buildings have outperformed their peers when inflation exceeded 5%. Multifamily assets generated 12.71% returns during such periods. Second best are industrial assets, which achieved 11.72% returns.[6]

As a long-term real estate investor, a macro environment with high inflation and rising interest rates can be a net positive. The results will depend in part on the holding period of your investment, the property type, the type of financing, and the underlying lease structure of the asset. Inflation can put upward pressure on both cap rates and real estate prices, but the right investment may allow you to maximize net operating income, maintain or increase the property’s overall value, and generate the best risk-adjusted returns for your portfolio.

- Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk. ↩︎

- Karlekar, Indraneel. “Can Commercial Real Estate Beat the Current High Inflation Environment?” Principal Asset Management, 5 July 2022, https://www.principalam.com/insights/economic-and-market-commentary/can-commercial-real-estate-beat-current-high-inflation. ↩︎

- US Inflation Calculator. “ Coffee Prices By Year and Adjusted For Inflation,” 21 Decc 2022, https://www.usinflationcalculator.com/inflation/coffee-prices-by-year-and-adjust-for-inflation/. ↩︎

- Winters, Mike. “Rising Interest Rates Cost Typical Homebuyers 16% of Purchasing Power.” CNBC, 28 June 2022, https://www.cnbc.com/2022/06/28/rising-interest-rates-cost-typical-homebuyers-16-percent-of-purchasing-power.html. ↩︎

- Cororaton, Scholastica. “Commercial Cap Rates Likely To Keep Compressing in 2022 Despite Higher Interest Rates.” NAR, 26 April 2022, https://www.nar.realtor/blogs/economists-outlook/commercial-cap-rates-likely-to-keep-compressing-in-2022-despite-higher-interest-rates. ↩︎

- HLC Equity, “A Historical Look at Multifamily Performance In Inlfationary Environments.” IREI, May 2022, https://irei.com/wp-content/uploads/2022/05/HLC-Equity-Whitepaper-A-Historical-Look-At-Multifamily-Performance-In-Inflationary-Environments-.pdf. ↩︎

Disclaimer

Educational Communication

Not AdviceThe views expressed above are presented only for educational and informational purposes and are subject to change in the future. No specific securities or services are being promoted or offered herein.

Not Advice

This communication is not to be construed as investment, tax, or legal advice in relation to the relevant subject matter; investors must seek their own legal or other professional advice.

Performance Not Guaranteed

Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are not guaranteed and may not reflect actual future performance.

Risk of Loss

All securities involve a high degree of risk and may result in partial or total loss of your investment.

Liquidity Not Guaranteed

Investments offered by Cadre are illiquid and there is never any guarantee that you will be able to exit your investments on the Secondary Market or at what price an exit (if any) will be achieved.

Not a Public Exchange

The Cadre Secondary Market is NOT a stock exchange or public securities exchange, there is no guarantee of liquidity and no guarantee that the Cadre Secondary Market will continue to operate or remain available to investors.

Opportunity Zones Disclosure

Any discussion regarding “Opportunity Zones” — including the viability of recycling proceeds from a sale or buyout — is based on advice received regarding the interpretation of provisions of the Tax Cut and Jobs Act of 2017 (the “Jobs Act”) and relevant guidances, including, among other things, two sets of proposed regulations and the final regulations issued by the IRS and Treasury Department in December of 2019. A number of unanswered questions still exist and various uncertainties remain as to the interpretation of the Jobs Act and the rules related to Opportunity Zones investments. We cannot predict what impact, if any, additional guidance, including future legislation, administrative rulings, or court decisions will have and there is risk that any investment marketed as an Opportunity Zone investment will not qualify for, and investors will not realize the benefits they expect from, an Opportunity Zone investment. We also cannot guarantee any specific benefit or outcome of any investment made in reliance upon the above.

Cadre makes no representations, express or implied, regarding the accuracy or completeness of this information, and the reader accepts all risks in relying on the above information for any purpose whatsoever. Any actual transactions described herein are for illustrative purposes only and, unless otherwise stated in the presentation, are presented as of underwriting and may not be indicative of actual performance. Transactions presented may have been selected based on a number of factors such as asset type, geography, or transaction date, among others. Certain information presented or relied upon in this presentation may have been obtained from third-party sources believed to be reliable, however, we do not guarantee the accuracy, completeness or fairness of the information presented.

No U.S. or foreign securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through us.

.svg)

.svg)

.svg)

.svg)

.png)