The people who make it possible.

Executive team

Our world-class professionals have a proven track record of excellence. They come from leading real estate private equity, asset management, technology, and engineering companies. Our team’s relentless drive to deliver compelling returns via our next-generation platform powers all aspects of our company’s performance.

Ryan Williams

Cadre Founder and Chief Executive Officer

Ryan Williams

Cadre Founder and Chief Executive Officer

Ryan A. Williams founded Cadre in 2014 to begin to level the playing field in commercial real estate investing, leveraging technology to provide institutions and individuals access to previously inaccessible real estate and alternative investment opportunities. The next-generation platform uniquely empowers individual investors to invest alongside institutions with lower minimums and fees than traditional private equity and offers first-of-its kind liquidity through a secondary trading market. Ryan, a native of Baton Rouge, Louisiana, and serial entrepreneur, has founded and scaled multiple companies over the past fifteen years. More recently, he started investing in real estate as an undergraduate student at Harvard University. Seeing the dislocation that resulted from the 2008 financial crisis, Ryan pooled funds from his classmates to acquire foreclosed homes in the Atlanta area, frequently working with previous owners to remain in their homes and eventually buy them back. This experience cemented in Ryan an ethos to “do well and do good.” After graduating from Harvard, Ryan worked at Goldman Sachs in its technology, media, and telecom group, and then at The Blackstone Group in its real estate private equity division. Ryan is regularly profiled as a top Founder and CEO. He was featured on the cover of Forbes Magazine in 2019 and has written extensively about the urgent need for social and economic justice for all members of society. Cadre is dedicated to doing business with local operators from diverse backgrounds and with community and Black-owned banks. Ryan and his family live in Brooklyn.

Dan Rosenbloom

Chief Investment Officer

Dan Rosenbloom

Chief Investment Officer

Dan Rosenbloom is the Chief Investment Officer for Cadre, responsible for scaling the firm’s investment capabilities. Dan has spent nearly 25 years building a proven track record in quality private equity real estate transactions. Previously, Dan served as Head of Acquisitions for Cadre, leading the firm’s acquisitions team and deal pipeline. Prior to Cadre, Dan led the acquisitions team at GEM Realty Capital while also serving on the investment committee and helping set the firm’s investment strategy. Prior to GEM, Dan served as Vice President at Fortress Investment Group, where he focused on acquisitions and originations of equity, mezzanine debt, and other subordinate debt secured by real estate assets and operating companies. Prior to Fortress, Dan worked in J.P. Morgan’s syndicate and leverage finance group, focusing on the real estate industry. He also worked at Jones Lang LaSalle, assisting with asset and portfolio sales, asset level debt and equity placements, and corporate finance transactions. Dan holds a B.B.A. from the University of Wisconsin-Madison and M.B.A. from Kellogg School of Management.

Madge Rumman

VP, Head of Product

Madge Rumman

VP, Head of Product

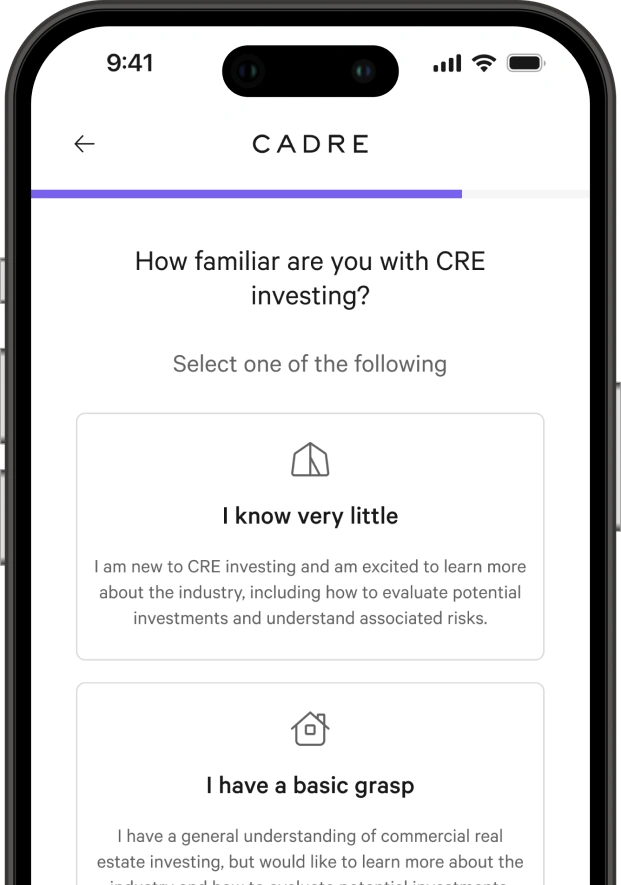

Madge Rumman is the Vice President, Head of Product for Cadre, leading the firm’s Product team and development of new innovative offerings. With an extensive background in consumer-oriented product development, Madge will oversee the team’s efforts at building out solutions to enable more efficient, tech-forward commercial real estate investment experience. Prior to Cadre, Madge served as Director of Product at Affirm. She previously served as the Head of Product at a leading Canadian buy-now-pay-later (BNPL) provider, PayBright, which was acquired by Affirm in 2021. In her role at PayBright, Rumman focused on leading the product function, including launching e-commerce and in-store BNPL offerings, building a consumer app, and expanding the department to more than 20 professionals. Following Affirm’s acquisition of PayBright, Madge also led the M&A integration efforts for the product stack and led product launches of key enterprise merchants, including the launch of the Apple partnership with Affirm in Canada. Madge previously worked at Interac Corp. as a Senior Manager in Product Strategy & Development, leading market development initiatives and strategic partnerships for core products. She also served as an Associate on consulting and deals for PricewaterhouseCoopers (PwC). Madge holds a BCom from the Smith School of Business at Queen’s University.

Karan Vazirani

VP, Finance

Karan Vazirani

VP, Finance

Karan Vazirani is Vice President of Finance, leading company-wide initiatives across corporate finance, investor relations, financing and analytics. He was an early member of the finance team and has helped significantly scale the function over the last four years. During his time at Cadre, Karan has assisted in raising over $75mm in corporate funding, including both equity and debt financing. He has led financial planning processes, helped develop go-to-market strategy for major firm projects, and contributed to scaling efforts across markets and sales. He also helped co-found Cadre's own philanthropic initiative, Cadre Cares. Prior to joining the firm, Karan was a private equity investment professional at Metalmark Capital (Formerly Morgan Stanley Capital Partners), where he led the due diligence process for new investment opportunities in various industries, including healthcare, energy, technology and financial services. Prior to that experience, he worked in investment banking at Greenhill & Co., advising clients on M&A, leveraged buyout, debt and equity transactions. Karan holds a B.S. from the Stern School of Business at New York University.

Josephine Scesney

Managing Director, Finance & Operations

Josephine Scesney

Managing Director, Finance & Operations

Josephine Scesney is a Managing Director of Finance & Operations at Cadre, responsible for overseeing fund management operations at the firm. One of the longest-tenured leaders at the firm, Josephine leads the company’s fund management function with decades of premier institutional experience. Prior to joining Cadre, Josephine worked at AllianceBernstein, where she was a Managing Director responsible for establishing reporting infrastructure for the Real Estate Group. Previously, she was a Managing Director in the Goldman Sachs Merchant Banking Division (MBD), where she served as Head of External Fund Information and Reporting for MBD’s Fund Management Group, led reporting and treasury functions for the firm’s Real Estate Principal Investments Area, and served as a Senior Accountant focused on investment accounting for real estate. Previously, Josephine worked as a Senior Accountant and Financial Analyst for Rockefeller Group. Josephine holds a B.B.A from Pace University.

Fabrice Tatieze

VP, Head of Engineering

Fabrice Tatieze

VP, Head of Engineering

Fabrice holds the position of Vice President, Head of Engineering at Cadre, where his leadership spans numerous teams, most notably, the Growth & Investments (G&I), Infrastructure, Customer Experience (CX), IT, and Banking/Accounting (Foundations), as well as the Data Science & Data Engineering teams. His unwavering dedication centers on crafting an unparalleled user experience for investors navigating the platform, while simultaneously safeguarding their valuable data and fostering an environment of efficiency, swiftness, and excellence for the software development process. Prior to his current role, Fabrice honed his expertise as an Engineering Manager at Shopify, overseeing the Marketing engineering team. Their efforts were laser-focused on customer acquisition and global marketing initiatives, penetrating new markets with remarkable finesse. Earlier in his career, spanning nine fruitful years at Nike, Fabrice commenced as an engineer, ascending to the position of Senior Engineering Manager. During his tenure at Nike, his pivotal focus encompassed the product detail page and the membership application, elevating these areas to new heights of innovation and success. Fabrice earned a bachelor's degree in Computer Science from the University of Bridgeport in Connecticut.

Ross Wasserman

Managing Director, General Counsel

Ross Wasserman

Managing Director, General Counsel

Ross Wasserman is Managing Director, General Counsel at Cadre, overseeing all legal and compliance functions across the business including Investments, Corporate, Investment Funds and Compliance. Prior to his role as General Counsel, Ross sat on the Investments Team focused on the legal structuring and execution of acquisitions, joint ventures, strategic partnerships and serving as a direct legal resource for asset management. Prior to joining Cadre, Ross practiced law at Fried, Frank, Harris, Shriver & Jacobson in its real estate department. At Fried Frank, Ross's practice covered a broad range of real estate transactions, including acquisitions, dispositions, joint ventures, construction financing, leasing, and the development of commercial, residential, and hospitality projects. Ross's former clients include GSAM Private Real Estate, The Related Companies, Vornado Realty Trust, SL Green Realty Corp., and Tishman Speyer Properties. Ross received his J.D. from the Benjamin N. Cardozo School of Law and holds a B.A. from the Gallatin School of Individualized Study at New York University.

Investment committee

Cadre’s Investment Committee has over 100 years of combined investing experience at companies like Goldman Sachs, Blackstone, Vornado, Four Seasons, PGIM Real Estate, and GEM Realty Capital. They have collectively transacted on tens of billions of dollars of commercial real estate across multiple investment cycles.

Ryan Williams

Cadre Founder and Chief Executive Officer

Ryan Williams

Cadre Founder and Chief Executive Officer

Ryan A. Williams founded Cadre in 2014 to begin to level the playing field in commercial real estate investing, leveraging technology to provide institutions and individuals access to previously inaccessible real estate and alternative investment opportunities. The next-generation platform uniquely empowers individual investors to invest alongside institutions with lower minimums and fees than traditional private equity and offers first-of-its kind liquidity through a secondary trading market. Ryan, a native of Baton Rouge, Louisiana, and serial entrepreneur, has founded and scaled multiple companies over the past fifteen years. More recently, he started investing in real estate as an undergraduate student at Harvard University. Seeing the dislocation that resulted from the 2008 financial crisis, Ryan pooled funds from his classmates to acquire foreclosed homes in the Atlanta area, frequently working with previous owners to remain in their homes and eventually buy them back. This experience cemented in Ryan an ethos to “do well and do good.” After graduating from Harvard, Ryan worked at Goldman Sachs in its technology, media, and telecom group, and then at The Blackstone Group in its real estate private equity division. Ryan is regularly profiled as a top Founder and CEO. He was featured on the cover of Forbes Magazine in 2019 and has written extensively about the urgent need for social and economic justice for all members of society. Cadre is dedicated to doing business with local operators from diverse backgrounds and with community and Black-owned banks. Ryan and his family live in Brooklyn.

Michael Fascitelli

Investment Committee Co-Chairman

Michael Fascitelli

Investment Committee Co-Chairman

Michael Fascitelli is the Co-Chair of Cadre’s Investment Committee, advising on Cadre’s growth strategies and investment decisions. Michael is a storied veteran in private equity real estate, formerly holding a number of prominent roles in the industry, including CEO of Vornado and Partner in the real estate division at Goldman Sachs. In addition to his role at Cadre, Michael is Founder of MDF Capital LLC and a Founder and Managing Partner at Imperial Companies. He also serves as a Trustee and Director of the Urban Land Institute, Executive Committee Member for the Wharton Real Estate Center, and is a part owner of the Milwaukee Bucks basketball franchise. As President and CEO of Vornado, Michael oversaw total returns of 4.2x the S&P 500 and 1.8x the NAREIT index, helped drive enterprise value to $29 billion from $1.2 billion, and executed more than 150 transactions, often including iconic properties across New York City. In 2010, he successfully established Vornado Capital Partners Fund I, which achieved $800 million in value. Prior to his role at Vornado, Michael served as a Partner at Goldman Sachs, primarily overseeing the firm’s Real Estate Department. He also served on the Investment Committee for the Goldman’s Whitehall Real Estate Fund. Before Goldman Sachs, he worked at McKinsey & Company. Michael holds a B.S. from University of Rhode Island and M.B.A from Harvard Business School.

Dan Rosenbloom

Chief Investment Officer

Dan Rosenbloom

Chief Investment Officer

Dan Rosenbloom is the Chief Investment Officer for Cadre, responsible for scaling the firm’s investment capabilities. Dan has spent nearly 25 years building a proven track record in quality private equity real estate transactions. Previously, Dan served as Head of Acquisitions for Cadre, leading the firm’s acquisitions team and deal pipeline. Prior to Cadre, Dan led the acquisitions team at GEM Realty Capital while also serving on the investment committee and helping set the firm’s investment strategy. Prior to GEM, Dan served as Vice President at Fortress Investment Group, where he focused on acquisitions and originations of equity, mezzanine debt, and other subordinate debt secured by real estate assets and operating companies. Prior to Fortress, Dan worked in J.P. Morgan’s syndicate and leverage finance group, focusing on the real estate industry. He also worked at Jones Lang LaSalle, assisting with asset and portfolio sales, asset level debt and equity placements, and corporate finance transactions. Dan holds a B.B.A. from the University of Wisconsin-Madison and M.B.A. from Kellogg School of Management.

Backed by the best

Cadre’s innovative commercial real estate investment platform has the financial backing of some of the largest and most respected venture capital firms, investment firms, real estate companies, and industry veterans.